Defined Contribution Plans

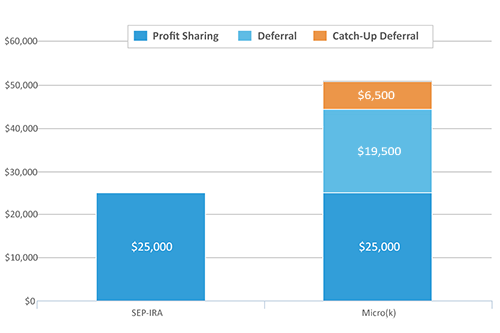

Your web portal for 401(k), Profit Sharing and Defined Contribution PlansSEP-IRA vs Micro(k)

Participant with $100,000 of W2 Wages in 2021

THE DEFINED CONTRIBUTION DIFFERENCE

Favorable tax laws have made 401(k) plans very attractive to the small business owner. The benefits of a Defined Contribution plan include::

- Increased Deferral Limits

- Roth 401(k) Option

- Automatic Enrollment

- “Safe Harbor” Feature

A Micro(k) plan is a low-cost 401(k) plan for businesses that have no rank-and-file (common-law) employees and require limited reporting and disclosure under ERISA. Should your client’s business have eligible employees, we can often design plans that will still favor the owners and perhaps other groups of employees (e.g. managers). All of our “Next Level” plans allow substantial investment freedom and the ability for participants to elect life insurance on themselves or family members.

The chart below details the various 401(k) plans Security Mutual Life offers.

| Micro(k)® | Safe Harbor 401(k) | Dash 401(k) | |

| Has Common-law Employees? | No, Owners Only | Yes | Yes |

| Owners are Older than Others? | N/A | No | Yes |

| Can Favor Specific Groups? | N/A | No | Yes |

| Prototype Plan? | Yes | Yes | No |

| Administrative Cost | Low | Moderate | High |

| May Offer Life Insurance | Yes | Yes | Yes |

| Suitable Funding Product | Annuities Life Insurance Mutual Funds Auxiliary Funds | Group Annuities Life Insurance Mutual Funds Managed Funds | Group Annuities Life Insurance Mutual Funds Managed Funds |

GET A DEFINED CONTRIBUTION DESIGN STUDY

Before we can help you review plan design options, we need to know three basic things:

- Who is there?

- What do they have now?

- What are the goals and/or the budget?

Use one of our “Form Fillable” Fact Finders to communicate your case to our qualified plans design team. For businesses with at least one owner and rank-and-file employees please use our standard Fact Finder (form no. 0010297XX). For an owner-only 401(k) plan, Security Mutual’s Micro(k) plan please use our Micro(k) Fact Finder (form no. 0011125XX).

The Design Team at Security Mutual Life provides comprehensive support to appointed representatives at no cost.

If you are not yet contracted with us but would like to discuss options please click here.

Download Section

401(k) & Profit Sharing Plans

Security Mutual Life offers flyers and product pieces and more related to our 401(k) and Profit Sharing plans.

Micro(k) Plans

Security Mutual Life offers flyers and product pieces and more related to our Micro(k) program.

SEP-IRA

Security Mutual Life offers a comprehensive package to start a SEP-IRA and more.

SAI Installation Forms

Download one of the comprehensive SAI installation packages that contain the necessary forms to set up a new qualified plan.

Additional Marketing Materials

Plan Limits & "P's & Q's"

You have pension questions, we have answers. View the 2018 plan limits, get answers to your pension questions.

Life Insurance Information & Sales Concepts

Learn about Security Mutual Life's unisex life insurance products offered in qualified plans, as well as sales concepts using those products.

Follow Us On

Security Mutual Life Insurance Company of New York

100 Court Street

PO Box 1625

Binghamton, New York 13902-1625

Phone: 1-800-346-7171